www.magazine-industry-usa.com

20

'20

Written on Modified on

Coronavirus: Dealing With ‘Unprecedented’ Changes to the Aerospace Industry

Never has the word ‘unprecedented’ been so widely used or more relevant than it is at a time when the whole world is talking about the Coronavirus (COVID-19) pandemic. The impact on our personal and working lives, global industry and the stock markets and our daily social routines and behaviours….is certainly unprecedented. By Rhys Williams, Editor for Metal Working EMEA

With airline bookings plummeting and restrictions on travel increasing, the safeguarding of consumer and workforce health is priority number one among businesses and governments around the world. It is forecast that air travel restrictions will persist for a prolonged period, but where is the light at the end of the tunnel?

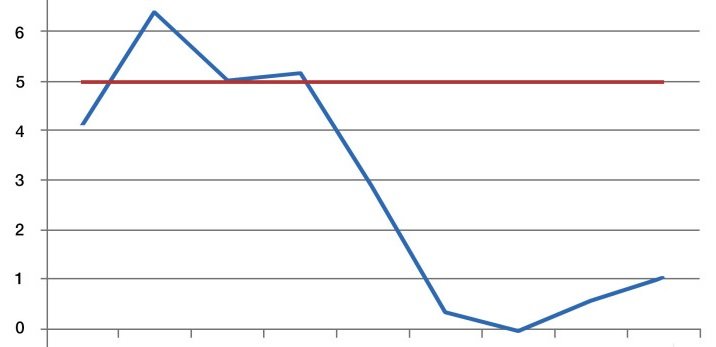

During previous crises like 9/11, SARS or the financial crisis of 2008/09, there was a recovery along a V- or U-shaped curve back to the pre-crisis growth path. As COVID-19 is a fully global crisis of unprecedented magnitude, we need to consider whether we might see an L-shaped recovery with consistently lower levels of air traffic and permanently slower growth after the crisis.

In the longer term, manufacturers are expected to face cash-flow shortages, production challenges and a cascading effect that may flow throughout the industrial base, impacting complex manufacturing. So, what can we expect in the future, how long will it last and how deep will the crisis be?

Expert analysts expect defence contractors to witness reduced demand and a slowing of the growth curve as national governments look to control expenses and reduce expenditure. The knock-on effect for manufacturers may be a loss of market share if they fail to deliver or fail to invest in next-generation technology during the downturn. Additionally, critical vendors in the supply chain may become financially stressed and require support.

For the civil aviation sector, the longer the flight restrictions last, the more airlines will run out of liquidity. This will bring the risk of bankruptcies, government nationalisations or consolidation, hence causing an irreparable change in the industrial landscape and customer structure for aircraft manufacturers. It is already reported that Italian flagship Alitalia is earmarked for renationalisation and no doubt more will likely follow. In addition to a possible domino effect of renationalisation’s, the longer the restrictions last, the greater the possibility that temporary behaviour changes imposed by the pandemic may become permanent – we may depend more on digital communication rather than international travel.

The immediate impact in numbers

The International Civil Aviation Organization (ICAO) has already published a preliminary report that estimates the COVID-19 impact on scheduled international passenger traffic during the first half of 2020. It highlights a reduction of 41 to 51% of seats offered by airlines when compared to pre-COVID schedules. This is an overall reduction of 443 to 561 million passengers, an estimated gross operating revenue loss of US$98 to 124bn for airlines.

As a timeline, international passenger capacity reduced by 8% in February as the outbreak started to take hold. When the impact went global in March, capacity reduced by 33%; and in April (so far) international passenger capacity has fallen by 85%.

…and the impact in real terms?

Analysts are churning through numbers and factoring-in several exit scenarios, these include a rebound to pre-COVID travel levels of 100% in the short-term, a delayed cure that will continue to the end of the year with the possibility of impacting 2021 flight schedules and a prolonged return to 90% capacity; or a recession created by prolonged travel restrictions and a return to 85% capacity by 2022.

The manufacturing outlook

Looking at these scenarios as a base model for global air traffic, there will be a new landscape for MRO services (Maintenance, Repair and Operations). Demand for MRO is driven by the size and activity of a global fleet; and as soon as aircraft are grounded, demand for all flight hour/flight cycle linked maintenance disappears. This makes MRO the first victim of the pandemic.

As and when MRO providers and spare parts suppliers return to any semblance of normality, airlines will be reconsidering the retirement of older aircraft, instigating potential deferrals or cancellations of current orders. As MRO activity picks up, the MRO supply chain will first consume existing inventory before purchasing new parts. Furthermore, shrinking fleets and aircraft that have been grounded may be disassembled with parts used as spares, further reducing demand from the supply chain.

Concerning new aircraft orders, it is perceived that there will be a dramatic slowdown in demand and the consequent fleet evolution of airlines. As a pre-pandemic reference point, global aircraft demand for the ten years from 2020-2030 was predicted to be around 21,760 new aircraft. It can only be assumed that as airlines are facing major financial difficulties, the aircraft replacement programmes will be postponed, especially as current fuel prices will make it more economically viable to continue flying older, less fuel-efficient aircraft.

In light of this, the challenge for the industry is threefold. Firstly, it must strive to minimise the postponement or cancellation of aircraft orders. The industry also has to survive and ‘bridge the time gap’ until the demand for new aircraft increases while keeping the aerospace supply chain alive and healthy; and finally, there needs to be a ramp-down of the supply chain to a new ‘norm’ whereby a sustainable medium-term production level can be achieved.

Boeing President and CEO Dave Calhoun recently issued a letter to staff estimating that global revenues will fall by US$314bn by the end of the year, as 2,500 aircraft are idled, and passenger volumes are down by 95% in the US. He went on to state that the industry is a vital pillar of the economy supported by 17,000 suppliers and 2.5million jobs. Emphasising the size and the importance of the sector and in particular, Boeing’s role within the industry is surely a plight to secure as much of the US government’s US$2trn support package as possible.

There will be a keen eye on Boeing’s next move and how it deals with a new reality regarding the demand for new aircraft. The new reality is not unique to the US manufacturer, as its European peer, Airbus has already announced its plans for the remainder of 2020. Airbus’ ‘Rate-60’ strategy of producing 60 narrow-body A320 aircraft a month has now been revised down to ‘Rate-40’ – not too long ago it was mooted how the company could achieve ‘Rate 90’ to meet the exceptional demand. This clearly shows how an ‘unprecedented’ pandemic can change the landscape so quickly for the industry. Airbus will also reduce the output of its wide-body A350 by 40% from 10 to 6 units a month with the A330 set to decline from 3 to 2 units a month. Whilst Boeing has not yet announced its plans, it is also expected to reduce output by 30-40%.

Light at the end of the tunnel

As with any ‘downturn,’ there will be winners and losers. With analysts expecting OEM’s to consolidate their supply chains, this will provide opportunities for many manufacturers. For a supply chain that has already invested in the latest manufacturing technology, principles and strategies; the future will eventually be bright. For those that have not yet streamlined and optimised their process flows and production equipment – now is the time to invest. If you are not currently in a position to invest, ‘breath’, ‘come up for air’ and take advantage of your spare time during the temporary output decline to review your business, look ahead and strategise how you can maximise your opportunities.