www.magazine-industry-usa.com

14

'19

Written on Modified on

Industrial Ethernet and Wireless are growing fast Industrial network market shares 2017 according to HMS

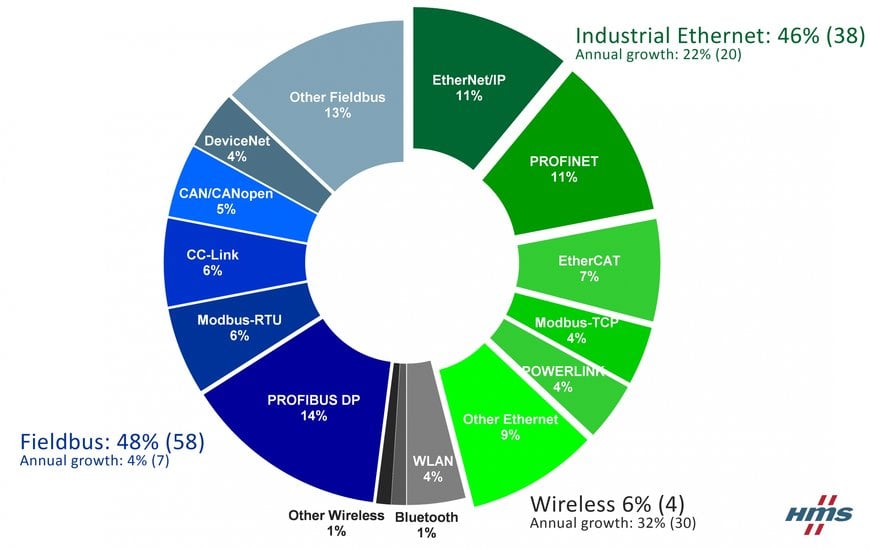

Industrial Ethernet and Wireless growth is accelerated by the increasing need for industrial devices to get connected and the Industrial Internet of Things. This is the main finding of HMS Industrial Networks’ annual study of the industrial network market. Industrial Ethernet now accounts for 46% of the market (38 last year). Wireless technologies are also coming on strong, now at 6% (4) market share. Combined, industrial Ethernet and Wireless now account for 52% of the market, while fieldbuses are at 48%.

HMS’s estimation for 2017 based on number of new installed nodes in 2016 within Factory Automation. The estimation is based on several market studies and HMS’s own sales statistics

HMS Industrial Networks now presents their annual analysis of the industrial network market, which focuses on new installed nodes within factory automation globally. As an independent supplier of products and services for industrial communication and the Internet of Things, HMS has a substantial insight into the industrial network market. Here are some of the trends they see within industrial communication in 2017.

Industrial Internet of Things is boosting Industrial Ethernet growth

According to HMS, industrial Ethernet is growing faster than previous years, with a growth rate of 22%. Industrial Ethernet now makes up for 46% of the global market compared to 38% last year. EtherNet/IP and PROFINET are tied at first place, with PROFINET dominating in Central Europe, and EtherNet/IP leading in North America. Runners-up globally are EtherCAT, Modbus-TCP and Ethernet POWERLINK.

“We definitely see an accelerated transition towards various industrial Ethernet networks when it comes to new installed nodes,” says Anders Hansson, Marketing Director at HMS. “The transition to industrial Ethernet is driven by the need for high performance, integration between factory installations and IT-systems, as well as the Industrial Internet of Things in general.”

Wireless is redefining the networking picture

Wireless technologies are growing quickly by 32% and now accounts for 6% of the total market. Within Wireless, WLAN is the most popular technology, followed by Bluetooth. “Wireless is increasingly being used by machine builders to realize innovative automation architectures and new solutions for connectivity and control, including Bring Your Own Device (BYOD) solutions via tablets or smartphones,” says Anders Hansson.

Fieldbus is still growing, but the growth is slowing down

Fieldbuses are still the most widely used type of networks with 48% of the market. Fieldbuses are still growing as many users ask for the traditional simplicity and reliability offered by fieldbuses, but the growth rate is slowing down, currently at around 4% compared to 7% last year. The dominant fieldbus is PROFIBUS with 14% of the total world market, followed by Modbus-RTU and CC-Link, both at 6%.

Regional facts

In Europe and the Middle East, PROFIBUS is still the leading network while PROFINET has the fastest growth rate. Runners up are EtherCAT, Modbus-TCP and Ethernet POWERLINK.

The US market is dominated by the CIP networks where EtherNet/IP has overtaken DeviceNet in terms of market shares.

In Asia, a fragmented network market is very visible. No network stands out as truly market-leading, but PROFIBUS, PROFINET, EtherNet/IP, Modbus and CC-Link are widely used. EtherCAT continues to establish itself as a significant network, and CC-Link IE Field is also gaining traction.

More and more devices are getting connected

“The presented figures represent our consolidated view, taking into account insights from colleagues in the industry, our own sales statistics and overall perception of the market,” says Anders Hansson. “It is interesting to see that industrial Ethernet and Wireless combined now account for more than half of the market at 52%, compared to fieldbuses at 48%. The success of a series of industrial Ethernet networks and the addition of growing Wireless technologies confirms that the network market remains fragmented, as users continue to ask for connectivity to a variety of fieldbus, industrial Ethernet and wireless networks. All in all, industrial devices are getting increasingly connected, boosted by trends such as Industrial Internet of Things and Industry 4.0. From our point of view, we are well-suited to grow with these trends, since HMS is all about ‘Connecting Devices.’”