www.magazine-industry-usa.com

16

'25

Written on Modified on

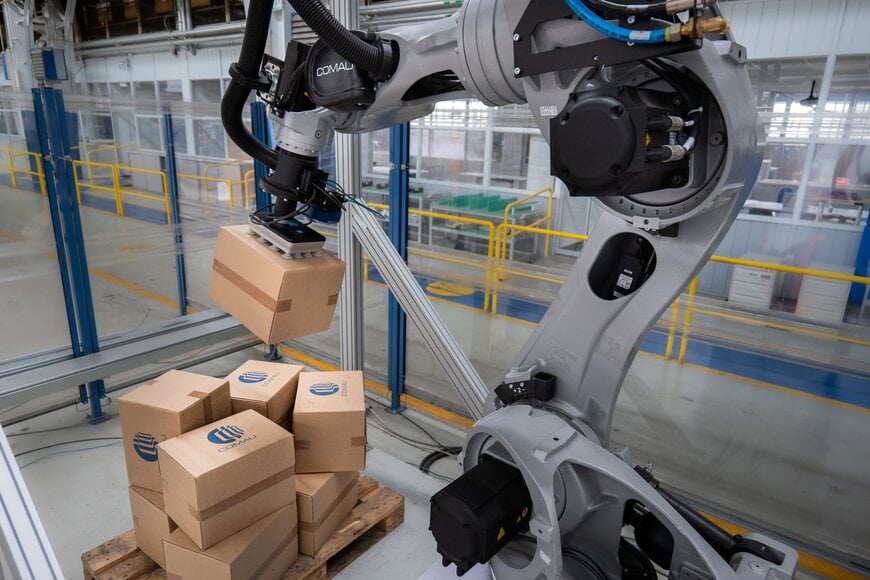

Comau enters into a binding agreement to acquire Automha

The strategic investment by Comau is a further step in building a forward-focused Italian automation Hub and will leverage the strong synergies between the two brands.

Comau has signed a binding agreement for the acquisition of Automha, an Italian company operating in the warehousing and intralogistics automation industry, owned by Trasma. The closing of the transaction is subject to the satisfaction of customary conditions precedent in transactions of this type, including necessary regulatory approvals, and is expected to occur in the second quarter of 2025. Under the terms of the agreement Comau will acquire 100% of Automha shares, paving the way for new opportunities within the rapidly growing warehousing and logistics sector and establishing a further step toward the creation of a forward-focused Italian industrial automation hub able to innovate and compete in multiple markets.

To ensure business continuity, Automha will continue to operate with the same structure, management and strategic vision, keeping people, quality and innovation at its core. Franco Togni will retain his position as CEO while Gianni Togni and Roberta Togni, in addition to continuing in their current roles, will join the Comau Executive Committee to contribute to the ongoing development of both companies.

This binding agreement is coherent with the strategy behind the recent change in Comau’s shareholder structure - whose majority share is now held by One Equity Partners, an international private equity firm - which has allowed Comau to become a standalone company. With this acquisition Comau reconfirms and strengthens its Italian roots and operations, while enhancing its global offer and international presence. In parallel, Automha will be able to scale-up and further develop its business by leveraging an enhanced geographical footprint and in-house technology competencies. Furthermore, given that Comau and Automha are fully complementary, the relationship will strengthen the mutual portfolio of projects.

“Expanding our reach, know-how and technology portfolio through the acquisition of innovative companies such as Automha is a crucial step in Comau’s growth strategy, as defined when we became a stand-alone company and implemented immediately after the closing phase,” said Pietro Gorlier, CEO of Comau. “In addition to capitalizing on the strong growth potential of warehousing and intralogistics markets, the integration of Automha within Comau will allow us to leverage our combined expertise and resources, to accelerate innovation and growth across a wide range of global industrial sectors.”

“When we invested in Comau, we saw a clear path forward to help the company expand strategically and gain scale. M&A is a main driver for this, and we identified warehouse, logistics and handling automation systems as a significant opportunity for this business,” said Ante Kusurin, Partner at One Equity Partners. “The acquisition of Automha is a move toward diversification of Comau’s operations and further taps the company into industrial automation trends improving productivity across many industries. We are excited for the opportunity ahead of us as these two complementary companies join forces.”

“In Comau we have found a partner who shares our values of quality, innovation, and commitment to customer success,” added Franco Togni, Founder of Automha. “This new chapter represents not only a moment of growth for Automha but also a continuation of the journey that began in 1979. I look forward to the future that lies ahead, knowing that together with Comau, we will continue to build excellence, expand our global impact and to reach a proper size to keep a leading position in a market that is increasing competitiveness and project dimensions.”

www.comau.com