www.magazine-industry-usa.com

06

'25

Written on Modified on

Sustainability in Electronic Components: Eco-Friendly Materials and Recycling Initiatives

Innovations in eco-friendly materials, closed-loop manufacturing, sustainable product design, and recycling systems offer a new vision for the future of electronics, writes K.A. Gerardino.

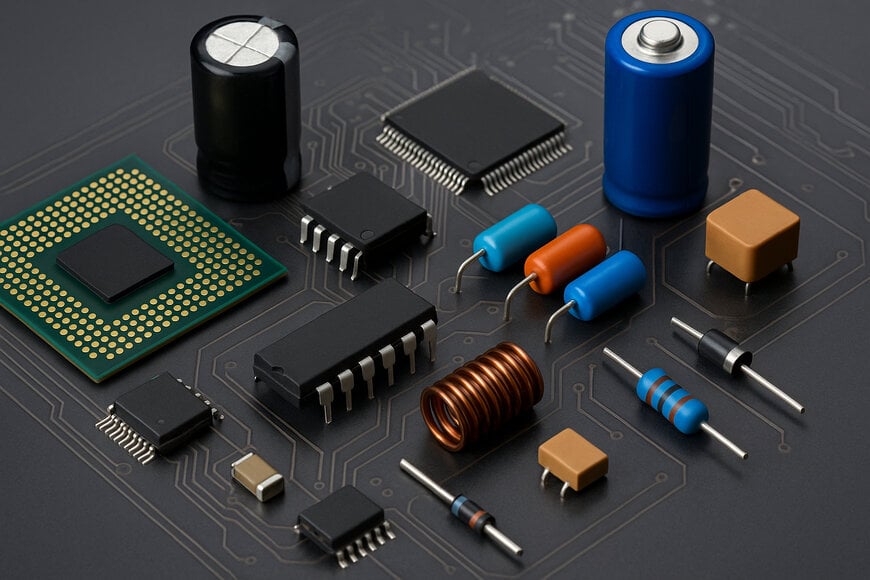

As global demand for electronic devices accelerates—driven by rapid advancements in consumer electronics, automotive technology, industrial automation, and the Internet of Things (IoT)—the environmental footprint of the electronics industry is drawing increased and justified scrutiny. The production of electronic components, from printed circuit boards (PCBs) and semiconductors to capacitors, resistors, connectors, and plastic housings, is resource-intensive and heavily reliant on processes that consume vast amounts of energy, water, and rare materials. These processes often involve hazardous substances, such as lead, mercury, brominated flame retardants (BFRs), and toxic solvents, which pose significant risks to both human health and the environment.

Compounding the issue is the industry’s continued dependence on a linear manufacturing model, where devices are designed for short-term use and are rarely built with reuse, repair, or recyclability in mind. As a result, mountains of electronic waste (e-waste) are generated every year—much of it ending up in landfills or informal recycling hubs, where it releases harmful pollutants and fails to recover valuable materials like gold, palladium, and rare earth elements. The United Nations estimates that over 62 million metric tonnes of e-waste were generated globally in 2023, a number expected to rise sharply unless significant reforms are adopted.

Yet, in the face of these environmental challenges, a transformative shift is underway. Innovations in eco-friendly materials, closed-loop manufacturing, sustainable product design, and recycling systems are offering a new vision for the future of electronics—one that balances technological progress with environmental responsibility. From biodegradable PCB substrates and halogen-free laminates to circular design principles and urban mining technologies, stakeholders across the value chain are investing in more sustainable alternatives.

This evolving landscape is being shaped not only by environmental necessity but also by regulatory pressure, consumer demand for greener products, and global initiatives aligned with the United Nations Sustainable Development Goals (SDGs). The electronics sector—historically seen as a contributor to environmental degradation—is now at a pivotal point where it can become a catalyst for circular economy practices, leading the charge in decarbonizing industry, conserving resources, and reducing waste through innovation and accountability.

As we delve deeper into the strategies and solutions being developed, it becomes clear that sustainability in electronic components is no longer a future aspiration—it is a present-day imperative with growing momentum across both industry and policy spheres.

The Environmental Impact of Electronic Components

The environmental impact of electronic components is significant and multifaceted, spanning the entire lifecycle of a product—from raw material extraction and component manufacturing to product use and end-of-life disposal. Each stage presents its own set of ecological challenges, contributing to climate change, resource depletion, and pollution.

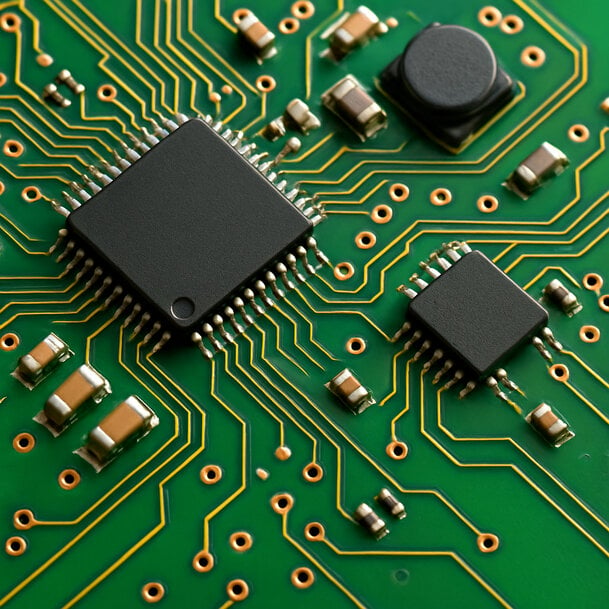

One of the most pressing concerns is the use of hazardous substances in the manufacturing of printed circuit boards (PCBs), which form the foundation of virtually all electronic devices. Traditional PCB production involves heavy metals like lead, cadmium, and mercury, as well as brominated flame retardants (BFRs) and volatile organic compounds (VOCs). These substances pose risks not only to human health during production and handling but also to ecosystems when devices are discarded improperly.

Equally problematic is the semiconductor fabrication process, which is among the most resource-intensive sectors in the electronics industry. Semiconductor manufacturing requires enormous quantities of ultrapure water, energy, and toxic chemicals such as arsine, phosphine, and hydrofluoric acid. According to the International Energy Agency (IEA), data centers and semiconductor fabs combined consumed over 2% of global electricity in 2023, with projections indicating continued growth as AI and high-performance computing demand increases. The carbon footprint of semiconductor production is particularly high in countries reliant on fossil-fuel-based electricity grids.

Meanwhile, the world's escalating dependence on digital devices—from smartphones and wearables to industrial control systems and electric vehicles—has led to an explosion of electronic waste (e-waste). The Global E-waste Monitor 2024 by UNITAR and the International Telecommunication Union (ITU) estimates that over 62 million metric tonnes of e-waste were generated worldwide in 2023. Shockingly, only about 17.4% of this was formally collected and recycled, and the trend is worsening. By 2030, the global collection and recycling rate is projected to drop to just 20%, primarily due to inadequate recycling infrastructure, lack of consumer awareness, and inconsistent regulatory enforcement in many regions.

This uncollected e-waste often ends up in landfills or informal recycling hubs, especially in developing countries, where it poses severe health and environmental risks. Toxic substances from decomposing electronics can leach into groundwater or release carcinogenic dioxins during incineration. Informal recycling practices, such as open-air burning and acid baths used to extract metals, contribute heavily to air and soil pollution, impacting nearby communities and biodiversity.

The environmental cost is also economic: according to the United Nations University (UNU), the raw materials embedded in e-waste—gold, platinum, palladium, copper, and rare earth elements—are worth over US$57 billion annually. Yet most of this value is lost due to poor recycling systems.

In light of these challenges, there is a growing consensus among industry leaders, governments, and environmental organizations that a fundamental redesign of electronics manufacturing and distribution systems is urgently needed. This includes rethinking the materials used, minimizing resource consumption, and building robust infrastructure for collection, reuse, and safe recycling. It also involves embedding sustainability principles at the design stage, often referred to as “Design for Environment” (DfE), which includes strategies such as modular design for easy repair, use of biodegradable or recyclable materials, and reduction of component complexity.

Additionally, initiatives like the European Union’s Green Deal, Right to Repair laws, and Extended Producer Responsibility (EPR) frameworks are gaining traction globally. These regulatory frameworks are pushing manufacturers to take accountability for the full lifecycle of their products, encouraging eco-innovation and circular economy models.

In summary, the environmental impact of electronic components is a critical concern that extends far beyond production. It encompasses systemic issues in energy use, toxic material handling, and waste management. Without decisive action and cross-sector collaboration, the industry risks exacerbating planetary boundaries. But with the integration of sustainable design principles, responsible sourcing, and effective recycling systems, there is a clear path forward—one that aligns technological progress with environmental protection.

Sustainable PCB Manufacturing: Eco-Friendly Materials and Innovations

Printed Circuit Boards (PCBs), the foundational elements of virtually all electronic devices, are among the most environmentally burdensome components due to their complex construction, intensive material requirements, and chemically harsh fabrication processes. Traditional PCBs typically consist of fiberglass-reinforced epoxy resins laminated with copper layers and treated with a host of chemicals during etching, plating, and cleaning. These steps often involve toxic heavy metals such as lead and chromium, halogenated flame retardants, and volatile organic compounds (VOCs), all of which pose risks to workers and contribute to air, water, and soil pollution if not properly managed.

While regulatory frameworks like the EU's Restriction of Hazardous Substances (RoHS) and REACH directives have prompted the industry to transition away from some of the most dangerous substances, including lead and cadmium, challenges remain. The widely adopted lead-free solder alloys, such as tin-silver-copper (SAC), while less toxic, still depend on the extraction of finite resources like silver and copper—processes that involve significant energy use, habitat disruption, and environmental degradation. Furthermore, these alloys may suffer from thermal fatigue issues, especially in high-reliability applications, raising questions about their long-term durability and sustainability.

In response, a new wave of research and innovation is reshaping the sustainability landscape of PCB manufacturing:

- Bio-based PCB substrates derived from cellulose, lignin, starch, and natural fiber composites are gaining attention for their biodegradability and renewability. Companies like Jiva Materials have developed commercially viable alternatives such as Soluboard, which dissolves in hot water, allowing for the easy recovery of components and materials without toxic processing. These materials can match traditional epoxy-based laminates in thermal and electrical performance for low-to-medium power applications, while drastically reducing end-of-life disposal issues.

- Green chemistry innovations are replacing traditional toxic solvents and etching agents with water-based solutions, ionic liquids, and supercritical CO₂. These alternatives reduce worker exposure to harmful chemicals, cut down on wastewater treatment costs, and reduce greenhouse gas emissions from volatile organic compounds.

- Additive manufacturing (3D printing), though still emerging for PCBs, is enabling more sustainable production models by reducing substrate waste, shortening design-to-manufacture cycles, and enabling on-demand, local manufacturing. Materials such as conductive inks based on silver nanoparticles or carbon nanotubes allow for the printing of flexible, lightweight PCBs with reduced energy input and material consumption. Researchers are also exploring inkjet-printed biodegradable PCBs, which could be suitable for transient electronics, such as medical implants or disposable sensors.

- Embedded component technology is helping reduce the number of discrete parts needed on a PCB, decreasing overall size and material usage. This design approach also improves electrical performance and thermal management, contributing indirectly to energy efficiency.

- Implementation of Life Cycle Assessment (LCA) tools has become critical for evaluating the true environmental impact of PCB manufacturing. LCA helps identify carbon hotspots, water usage, and material inefficiencies throughout the value chain—from raw material extraction to end-of-life management—enabling manufacturers to optimize design and production decisions for minimal environmental harm.

- Furthermore, renewable energy integration in PCB fabrication plants is emerging as a trend, with companies investing in solar panels, battery storage systems, and energy-efficient HVAC solutions to reduce Scope 2 emissions. For example, leading EMS providers in Europe and Japan have already begun reporting emissions reductions through such facility upgrades.

In combination, these innovations represent a significant departure from the conventional PCB manufacturing model, offering new pathways to reduce toxicity, energy consumption, and waste. However, the adoption of sustainable PCB solutions is still uneven across the industry, with cost, performance trade-offs, and limited standardization posing hurdles to widespread implementation. Scaling these technologies—especially among small and mid-sized manufacturers—will require not only technological refinement but also policy support, supply chain incentives, and market demand for greener electronics. Nonetheless, the momentum is building, and sustainable PCB manufacturing is poised to play a pivotal role in the broader decarbonization and circularity of the electronics industry.

Circular Manufacturing and End-of-Life Management

To further enhance sustainability in the electronics sector, the adoption of a circular manufacturing model is becoming an increasingly critical strategy. Unlike the traditional linear model of "take, make, dispose," circular manufacturing seeks to maximize the lifecycle of materials through reuse, refurbishment, remanufacturing, and recycling—drastically reducing the demand for virgin raw materials and minimizing waste.

In this model, Printed Circuit Boards (PCBs) and other components are designed with ease of disassembly in mind, allowing for the retrieval of valuable and finite resources such as gold, silver, copper, palladium, and rare earth elements. Design features like non-permanent adhesives, standardized fasteners, and layered modular assemblies make it easier to separate components at the end of a product’s life. This is especially vital as raw material prices soar and concerns grow over supply chain vulnerabilities and conflict minerals.

Modular product design plays a central role in circularity. By allowing individual components—such as memory chips, sensors, batteries, and display units—to be upgraded or replaced independently, manufacturers can extend the useful life of a product without having to replace the entire system. Notable examples include the Fairphone, which enables users to swap out cameras, batteries, and processors with minimal tools, and Framework’s modular laptops, which are built entirely around repairability and upgradeability.

Several companies and programs are already implementing circular practices:

Circular Manufacturing and End-of-Life Management

To further enhance sustainability in the electronics sector, the adoption of a circular manufacturing model is becoming an increasingly critical strategy. Unlike the traditional linear model of "take, make, dispose," circular manufacturing seeks to maximize the lifecycle of materials through reuse, refurbishment, remanufacturing, and recycling—drastically reducing the demand for virgin raw materials and minimizing waste.

In this model, Printed Circuit Boards (PCBs) and other components are designed with ease of disassembly in mind, allowing for the retrieval of valuable and finite resources such as gold, silver, copper, palladium, and rare earth elements. Design features like non-permanent adhesives, standardized fasteners, and layered modular assemblies make it easier to separate components at the end of a product’s life. This is especially vital as raw material prices soar and concerns grow over supply chain vulnerabilities and conflict minerals.

Modular product design plays a central role in circularity. By allowing individual components—such as memory chips, sensors, batteries, and display units—to be upgraded or replaced independently, manufacturers can extend the useful life of a product without having to replace the entire system. Notable examples include the Fairphone, which enables users to swap out cameras, batteries, and processors with minimal tools, and Framework’s modular laptops, which are built entirely around repairability and upgradeability.

Several companies and programs are already implementing circular practices:

- Apple uses disassembly robots like Daisy and Dave to recover components from returned devices and extract rare materials for reuse in new products. Apple also reuses materials such as recycled cobalt in batteries, reclaimed gold in logic boards, and recycled aluminium in enclosures.

- Cisco launched a Takeback and Reuse Program which recovers old networking equipment from customers and reintroduces parts into new systems. In FY2023, Cisco reused or recycled nearly 99.9% of returned hardware by weight.

- Dell operates one of the largest global electronics recycling programs and incorporates recycled plastics, carbon fiber, and rare earth magnets into new products. It also partners with recycling centers and NGOs in developing countries to create responsible e-waste infrastructure.

- Panasonic and Sony have invested in facilities for closed-loop plastic recycling, enabling them to produce new devices using plastics reclaimed from older units, thereby cutting down both plastic waste and oil dependency.

Circular manufacturing also involves innovative recovery technologies. Methods such as cryogenic separation, laser ablation, chemical-free PCB depopulation, and bioleaching (using bacteria to extract metals from e-waste) are being explored to increase recovery efficiency and reduce environmental impact.

Despite the promise, the pace of circular transition across the industry remains uneven and relatively slow. Several challenges persist:

- SMEs (Small and Medium Enterprises), which make up a large portion of the electronics supply chain, often lack access to the capital, technical knowledge, and infrastructure needed to redesign products or invest in sophisticated recycling and remanufacturing capabilities.

- The fast-paced innovation cycles typical of consumer electronics push companies to launch new models frequently, sometimes at the expense of repairability or backward compatibility. This built-in obsolescence undermines circularity goals.

- Lack of standardization across product categories and regions hinders disassembly and recycling efforts. A fragmented approach to material labeling, component sizing, and assembly techniques makes recovery more complex and less economically viable.

- Regulatory inconsistencies across global markets can either encourage or deter circular practices. While the European Union’s Circular Economy Action Plan and EcoDesign Directive are setting strong precedents for product longevity, repairability, and material efficiency, many countries still lag in enforcement and incentives.

Going forward, a more robust circular approach will require:

- Policy support, including tax incentives for sustainable design, mandatory product take-back schemes, and eco-labeling for recyclability and repairability.

- Collaborative platforms where OEMs, recyclers, material suppliers, and logistics providers can exchange best practices and standardize recovery processes.

- Consumer engagement, as awareness and participation in recycling and repair programs remain low in many markets.

- Digital product passports, as proposed by the EU, which would provide detailed data on component origin, material composition, and disassembly instructions to facilitate recovery and recycling.

Circular manufacturing and effective end-of-life management represent one of the most powerful levers the electronics industry can pull to reduce its environmental footprint. When properly executed, it not only reduces e-waste and raw material dependency but also creates new business models focused on service, refurbishment, and resource recovery—moving the sector closer to a truly regenerative and resilient electronics ecosystem.

Sustainable Practices in Component Distribution

Beyond manufacturing, electronic component distribution plays a pivotal role in sustainability. The distribution process—from sourcing and inventory management to packaging and logistics—offers multiple avenues for reducing environmental impact.

One of the most immediate areas for improvement is eco-friendly packaging. Distributors are beginning to replace traditional plastic-based packaging with recyclable, biodegradable alternatives. Additionally, streamlining logistics through optimized shipping routes, consolidated deliveries, and the adoption of electric vehicles for last-mile delivery can significantly cut carbon emissions.

The implementation of sustainable inventory management systems is also critical. By using advanced forecasting tools and AI-driven analytics, distributors can better match supply with demand, reducing obsolete stock and e-waste. Moreover, recovery and resale of unused or refurbished components not only contributes to a circular economy but also enhances the distributor’s value proposition.

Collaboration and Transparency Across the Supply Chain

True sustainability in electronics requires coordinated, cross-functional collaboration across the entire supply chain—from raw material suppliers and component manufacturers to OEMs, contract assemblers, and distributors. This cooperation is essential not only to standardize sustainability metrics—such as carbon intensity per unit, water usage, or recycled content ratios—but also to ensure the use of ethically sourced, conflict-free, and low-impact materials.

Technologies like blockchain and digital product passports are being increasingly explored to trace the origin, handling, and lifecycle of electronic components. These tools enable both businesses and consumers to verify environmental and social compliance at every stage, from mining and manufacturing to distribution and end-of-life. Enhanced transparency empowers stakeholders to make informed decisions and hold suppliers accountable, especially in the context of ESG (Environmental, Social, and Governance) targets and regulatory frameworks such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the U.S. Dodd-Frank Act on conflict minerals.

A growing number of companies—spanning both multinationals and emerging innovators—are already taking proactive steps:

Sustainable Practices in Component Distribution

Beyond manufacturing, electronic component distribution plays a pivotal role in sustainability. The distribution process—from sourcing and inventory management to packaging and logistics—offers multiple avenues for reducing environmental impact.

One of the most immediate areas for improvement is eco-friendly packaging. Distributors are beginning to replace traditional plastic-based packaging with recyclable, biodegradable alternatives. Additionally, streamlining logistics through optimized shipping routes, consolidated deliveries, and the adoption of electric vehicles for last-mile delivery can significantly cut carbon emissions.

The implementation of sustainable inventory management systems is also critical. By using advanced forecasting tools and AI-driven analytics, distributors can better match supply with demand, reducing obsolete stock and e-waste. Moreover, recovery and resale of unused or refurbished components not only contributes to a circular economy but also enhances the distributor’s value proposition.

Collaboration and Transparency Across the Supply Chain

True sustainability in electronics requires coordinated, cross-functional collaboration across the entire supply chain—from raw material suppliers and component manufacturers to OEMs, contract assemblers, and distributors. This cooperation is essential not only to standardize sustainability metrics—such as carbon intensity per unit, water usage, or recycled content ratios—but also to ensure the use of ethically sourced, conflict-free, and low-impact materials.

Technologies like blockchain and digital product passports are being increasingly explored to trace the origin, handling, and lifecycle of electronic components. These tools enable both businesses and consumers to verify environmental and social compliance at every stage, from mining and manufacturing to distribution and end-of-life. Enhanced transparency empowers stakeholders to make informed decisions and hold suppliers accountable, especially in the context of ESG (Environmental, Social, and Governance) targets and regulatory frameworks such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the U.S. Dodd-Frank Act on conflict minerals.

A growing number of companies—spanning both multinationals and emerging innovators—are already taking proactive steps:

- Intel, Infineon, and STMicroelectronics are not only reducing carbon emissions through renewable energy procurement but also investing in green fabs, closed-loop water systems, and low-impact packaging materials. STMicroelectronics has committed to becoming carbon neutral by 2027, one of the most ambitious goals in the semiconductor sector

- Apple has developed a highly integrated closed-loop supply chain strategy, including its recycling robot "Daisy" for iPhones and the use of 100% recycled rare earth elements in some of its products. Apple’s Supplier Clean Energy Program has pushed more than 300 suppliers to commit to renewable electricity.

- Dell Technologies is pioneering circular design by incorporating recycled plastics and carbon fiber into its products and offering free global take-back programs for old electronics. Dell aims to reuse or recycle an equivalent product for every device a customer buys by 2030.

- Jiva Materials, a UK-based startup, has introduced Soluboard, a water-soluble PCB substrate made from natural fibers, offering a biodegradable solution for non-critical electronics and helping recover valuable components without chemical processing.

- Sony has set comprehensive environmental targets under its "Road to Zero" program, with ambitions to achieve a zero environmental footprint by 2050, including low-power IC design, water-saving technologies, and green logistics.

- HP is using ocean-bound plastics in its ink cartridges and laptops and has committed to zero deforestation in its paper-based product packaging. Its Sustainable Impact report is now integrated into its annual financial filings to demonstrate accountability.

- Flex (formerly Flextronics), a global EMS provider, has implemented sustainability scorecards across its supply chain and adopted supplier carbon data dashboards to monitor and reduce Scope 3 emissions.

- Samsung Electronics is working toward carbon neutrality in its device experience division by 2030, expanding its use of recycled plastics and integrating circular economy principles into its production and R&D strategies.

- Arrow Electronics and Avnet, leading component distributors, are investing in sustainable logistics, eco-friendly packaging, and digital inventory tools to reduce waste and emissions in the component distribution process.

- Fairphone, a social enterprise based in the Netherlands, stands out for its modular smartphone design, use of ethically sourced tin, tungsten, and cobalt, and active participation in responsible mining cooperatives in Africa.

These examples reflect a growing realization: sustainability is no longer a siloed responsibility—it is a system-wide endeavor. As more companies embed circularity, traceability, and ethical sourcing into their operations, the electronics industry moves closer to a resilient, transparent, and low-carbon future. To accelerate this shift, future efforts must emphasize open data standards, cross-industry consortia, and inclusive engagement of smaller suppliers, many of whom need support and resources to align with global sustainability goals.

Market Trends, Challenges, and Future Goals

According to MarketsandMarkets, the global green electronics market is expected to reach USD 150 billion by 2030, growing at a CAGR of over 10%. Drivers include increased regulatory pressure, consumer demand for sustainable products, and corporate ESG commitments.

Still, challenges remain. The lack of standardization, high upfront costs, and inconsistent awareness across regions and company sizes create roadblocks. Furthermore, the short-term mindset prevalent in consumer electronics—where rapid innovation drives frequent product obsolescence—undermines long-term sustainability objectives.

To overcome these barriers, the industry must focus on:

Market Trends, Challenges, and Future Goals

According to MarketsandMarkets, the global green electronics market is expected to reach USD 150 billion by 2030, growing at a CAGR of over 10%. Drivers include increased regulatory pressure, consumer demand for sustainable products, and corporate ESG commitments.

Still, challenges remain. The lack of standardization, high upfront costs, and inconsistent awareness across regions and company sizes create roadblocks. Furthermore, the short-term mindset prevalent in consumer electronics—where rapid innovation drives frequent product obsolescence—undermines long-term sustainability objectives.

To overcome these barriers, the industry must focus on:

- Policy incentives that reward sustainable practices and penalize environmentally damaging behaviors.

- Education and training to bridge the knowledge gap, especially for SMEs.

- Investment in R&D to improve the reliability and affordability of green materials and processes.

- Global collaboration to harmonize standards and accelerate scalable solutions.

Conclusion: Paving the Way for Sustainable Electronics

Sustainability in electronic components is no longer a niche concern—it is a global imperative. As the electronics industry continues to expand, it must do so without compromising the planet’s future. By integrating eco-friendly materials, adopting green manufacturing and distribution practices, and embracing circular economy principles, companies can reduce their environmental footprint while enhancing their competitive edge.

The path ahead requires bold leadership, cross-industry collaboration, and a willingness to invest in long-term change. But with innovation and resolve, the electronics industry has the potential to become not only smarter and faster—but greener, too.

Sustainability in electronic components is no longer a niche concern—it is a global imperative. As the electronics industry continues to expand, it must do so without compromising the planet’s future. By integrating eco-friendly materials, adopting green manufacturing and distribution practices, and embracing circular economy principles, companies can reduce their environmental footprint while enhancing their competitive edge.

The path ahead requires bold leadership, cross-industry collaboration, and a willingness to invest in long-term change. But with innovation and resolve, the electronics industry has the potential to become not only smarter and faster—but greener, too.